Each fall, Spirit Halloween reappears like clockwork — filling empty storefronts in malls and power centers with aisles of costumes and décor. For roughly 60 to 90 days, the brand transforms vacant retail space into a highly profitable seasonal destination, then disappears until next year. It’s a lean, opportunistic model built on shortterm leases and sharp timing.

Spirit Halloween now operates more than 1,500 temporary locations across North America, capturing a share of the $12.2 billion consumers are expected to spend on Halloween this year. Its success has inspired a wave of similar ventures — from pop-up toy stores that open before Christmas to temporary “Valentine” boutiques and fireworks stands. The appeal is clear: minimal risk, maximum seasonality. And in an era when the lead-up to major holiday seasons seems to grow longer and longer (yes, “Summerween” is now a thing), being able to capitalize on seasonal surges in demand is the difference between surviving and thriving.

For traditional retailers, the rise of the pop-up represents both disruption and opportunity. Seasonal spending is critical — the National Retail Federation reports that nearly 20% of all annual retail sales occur during the holiday period. When short-term stores siphon off those dollars, year-round operators can see meaningful hits to revenue. Specialty shops like independent costume, toy, and décor stores are especially vulnerable, losing share during the very weeks that once defined their profitability.

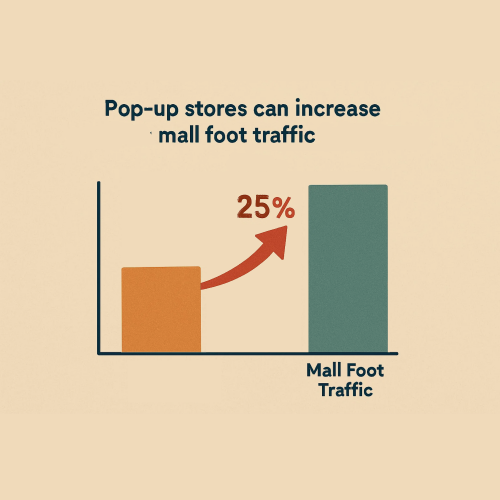

Yet, the picture isn’t entirely negative for traditional retailers. Studies by ICSC show that pop-up stores can increase mall foot traffic by as much as 25%. Savvy retailers in the immediate vicinity stand to benefit from such increased traffic.

Some retail operators have learned to turn the seasonal model to their advantage. In the early 2000s, New York–based Ricky’s famously launched temporary Halloween outlets as an extension of its beauty and accessories business, using pop-ups to capitalize on seasonal demand without diluting its core brand. Big-box retailers like Target and Walmart have also experimented with pop-up concepts to test new categories, locations, or online-to-offline experiences.

For traditional retailers, the lesson isn’t to fight the temporary model but to learn from it. Here are several ways retailers can better take advantage of seasonal surges in demand:

In a world where holidays begin sooner and celebrate wider audiences, adaptability isn’t optional—it’s essential. Retailers that pivot fast, scale smart, and exploit seasonality on their own terms won’t just survive the pop-up wave—they’ll ride it.