Some of the world’s largest and most successful private brands are extensions of the banner brand. Tesco and Asda in the UK. Trader Joe’s, Kroger, HEB and Meijer in the US.

What’s great about these brands is that, for a shopper, they are easy to understand because they deliver on the same brand promise as the store banner. Asda products are going to offer a great deal. Trader Joe’s products will provide a taste adventure. They are clear and straightforward.

But in a world of ever-increasing fragmentation in tastes and preferences, are these wide-ranging banner brands still relevant? Or will they give ground to private brand portfolios with a wider collection of more focused, targeted brands?

EARLY PRIVATE BRANDS

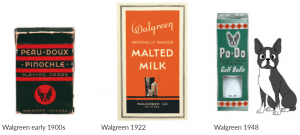

For many years, banner brands dominated the private brand landscape. These brands draw on the retailer’s brand equity and typically span most, if not all, categories across the store. Since the brick-and-mortar retail store already had established a reputation in its geographic area, the private brand product was often simply endorsed by the banner.

Most of these early banner brands were positioned as value brands; priced significantly below the national brand equivalent product, these value brand offered the retailer self-determined margins and pricing. This elasticity allowed the retailer to cater to a broader array of price points and broader shopper needs.

These early banner brand executions were often managed by suppliers with rather lax brand guidelines and standards. Brand inconsistency was common and accepted as the norm. Shoppers also couldn’t count on what to expect across categories as adherence to standardized product guardrails was often equally inconsistent.

THE RISE OF PRIVATE BRAND TIERS

As banner brands won greater consumer acceptance, retailers recognized the opportunity to improve consistency to generate even greater revenue, margin and market share. Retailers began to take even greater control of their own brands, instilling more consistent product and design standards and asserting more control over brand management.

With these changes, the banner brand typically migrated into the National Brand Equivalent (NBE) tier. Shoppers came to see banner brands offering similar taste and performance to their well-known national brand, shrinking the perceived quality gap.

This left a void in the value segment of the market, which retailers began to fill with stand-alone OPP (opening price point) brands. In many executions, these brands did not include the store brand name on the packaging. Since these brands were expected to be lower in performance, it made sense not to tie the value brand to the trusted equity of the store banner.

Next was the proliferation of premium grocery brands which are elevated “above” the national brands. These premium brands, for the first time, provided a real “destination brand”.

Private brands were no longer simply enhancing retailer margins; they had become drivers of store traffic as they became a key differentiator among retailers. According to a recent study by the Food Marketing Institute (FMI), 46% of grocery shoppers say that private brands are very influential when deciding where to shop, up from 35% three years prior.

THE PROLIFERATION OF LIFESTYLE BRANDS

These targeted brands allow retailers to address different need states by building each brand around one or two very targeted product attributes shared by the entire brand line-up. As shoppers continue to fragment in their preferences and seek brands that align with their values, these targeted brands are likely to outperform broader, more generic brand offerings.

THE CHALLENGE: BANNER ASSOCIATION

For retailers who offer a large portfolio of distinct private brands, one challenge that emerges is banner association. For a private brand to successfully drive store traffic, it’s important that consumers understand they are exclusive to a specific retailer.

The advantage banner brands have here is clear, with the banner brand clearly labelled on every pack. Every Trader Joe’s product delivers on its brand promise of discovery and fun. Meijer compliments its NBE Meijer brand with brands in which Meijer acts as the endorser: Fresh from Meijer and Frederik’s by Meijer. Asda’s Just Essentials value brand has ASDA as a prominent design element on pack.

Every shopper knows where to find each of these private brands.

Conversely, retailers with a portfolio of targeted private brands with no association to the banner must engage in more promotional activity to tie the retail banner and private brands together in shoppers’ minds. Loblaws in Canada typically spends more promoting its flagship private brands President’s Choice and No Name than it does on retail banner marketing.

Tesco offers an interesting case study. Its Tesco Value (later Tesco Everyday Value) brand was a staple in UK households for over two decades. However, in 2016 Tesco Everyday Value was replaced by a lineup of over 8 category specific brands to combat erosion of market share to value-focused retailers Aldi and Lidl. From a branding perspective, each of these distinct brands such as Hearty Food Company, Ms. Molly’s and Rosedene Farms is emblazoned with an “Exclusively at Tesco” badge to create the banner association.

THE FUTURE OF BANNER BRANDS

THE FUTURE OF BANNER BRANDS

So, in the final analysis, the banner brand is alive and well in private brand strategy. How it is used will be dependent on the portfolio brand architecture system developed by the retailer. And, critically, the question is how does the retail marketing team want to tie the banner equity to the product on the brick-and-mortar and digital shelves.